content 内容目录

0 Introduction 介绍

1 Raw Materials Market Analysis 原材料市场分析

2 Resins 树脂

3 Pigments 颜料

4 Solvents 溶剂

5 Additives 添加剂

6 Regional Distribution 地区分布

7 Market Trends 市场趋势

Introduction 介绍

Copyrights reserve to The ChemQuest Group, Inc.

版权归属ChemQuest

Coatings raw materials can be grouped into four broad categories of chemical constituents:

Resins, Pigments, Solvents and Additives

涂料原料可分为四大类成分:树脂、颜料、溶剂和添加剂

The global coatings raw material market is estimated to be valued at approximately $63.5 billion on 34.3 million metric tons of materials.

全球涂料原料市场估值约635亿美元,约3,430万吨。

1. Raw Materials Market Analysis 原材料市场分析

Raw materials used in the manufacturing of paints and coatings represent a relatively small (~5%) but extremely important component of the $4.5 trillion global chemicals industry. All of the world’s leading chemical producers are active in the coatings market, and many coatings raw materials are used in other industries as well, including plastics; synthetic lubricants; adhesives; sealants; household, industrial and institutional cleaners (HI&I); personal care products; paper; water treatment and many others. The basic chemical components that are used to produce coatings chemical constituents can also be used to produce a wide array of other chemical compounds. This can be a problem at times, since this diversity of uses can create competitive situations for raw materials and their pre-cursors that are typically used in coatings, particularly during periods of tight supply.

涂料原材料在全球4.5万亿美元的化学工业中,所占的份额相对较小(约5%),但极为重要。世界上所有领先的化学生产商都活跃在涂料市场上,许多涂料原料也用于其他行业,包括塑料、合成润滑剂、胶粘剂、家用密封胶、工业和公共场所清洁剂、个人护理产品、纸、水处理等。用于生产涂料的基本化学成分也可以用于生产各种其他化合物,有时这可能是一个问题,因为这种多样性用途会给涂料原材料及其上游市场带来竞争,特别是在供应紧张期间。

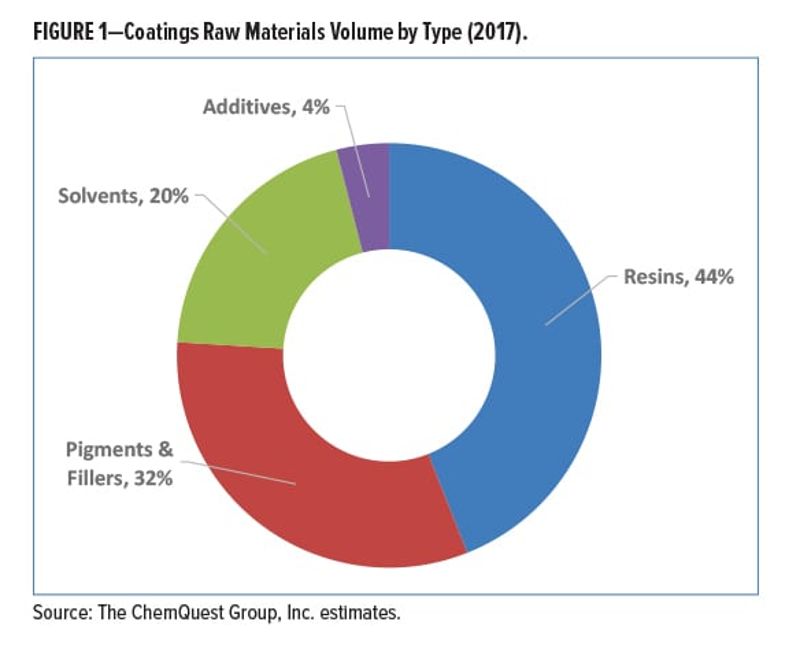

Resins (“binders”), pigments, and fillers represent over 75% of the global coatings raw materials market. Figure 1 shows the estimated distribution of coatings raw materials volume by type.

树脂、颜料和填充剂占全球涂料原料市场的75%以上。图1显示了按类型估算的涂料原料产量分布。

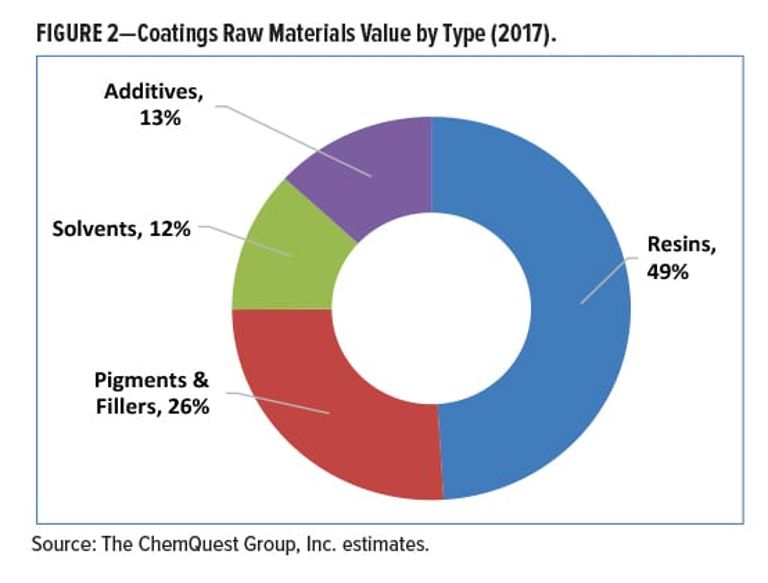

As might be readily anticipated, the distribution of the types of raw materials, based upon value, is somewhat different than distribution based on volume. Figure 2 shows the estimated distribution of coatings’ raw materials value by type.

很容易预料,基于产值的原材料类型分布与基于产量的分布有所不同。图2显示了按涂料原材料产值的类型分布。

2. Resins 树脂

Total global sales of resins for use in coatings systems are estimated to be $31 billion on roughly 15.2 million metric tons.

涂料用树脂全球总销售额约为310亿美元,约合1,520万吨。

Globally, acrylic resins are the most commonly used binder in paint and coatings systems. This is particularly true for decorative paints, and includes all acrylics, both pure and modified, such as styrene-acrylics and vinyl-acrylics. It is estimated that acrylic systems, both solventborne and waterborne, comprise approximately 27% of total coatings binder demand. It should be no surprise then, that acrylic resins tend to be the most susceptible to periodic disruptions in supply, accompanied by price fluctuations. In 2017, for example, shortages of methyl methacrylate (MMA), due to a variety of causes, including a shortage of acetone and two major U.S. suppliers of MMA being down (for different reasons) at the same time, led to nearly monthly increases, with MMA climbing roughly $0.50/lb, from “mid-$0.80s/lb” in February 2017 to “mid-$1.30s”/lb in January 2018. Prices on both the spot market and the black market during 2017 were reported to be “sky high.” While supplies are somewhat more stable going into 2018, price increases were announced for both January and February, and there are still likely to be additional increases.

在全球范围内,丙烯酸树脂是涂料体系中最常用的化学成分,尤其是装饰涂料,包括所有纯的和改性的丙烯酸,例如苯乙烯-丙烯酸和乙烯基-丙烯酸。据估计,丙烯酸体系,包括溶剂型和水性的,约占涂料用树脂总量的27%。不足为奇的是,丙烯酸树脂往往最容易受到周期性供应中断以及价格波动的影响。例如,在2017年,由于多种原因造成的甲基丙烯酸甲酯(MMA)短缺,包括丙酮短缺以及美国的两个主要MMA供应商同时下降(由于不同的原因),导致几乎每月的增长,其中MMA上涨了约0.50美元/磅,从2017年2月的“ 0.80美元/磅的中间价”升至2018年1月的“ 1.30美元/磅的中间价”。据报道,2017年现货市场和黑市的价格均为“高空”。尽管进入2018年的供应较为稳定,但已宣布1月和2月价格上调,并且仍有可能进一步上涨。

On a global basis, alkyds are used to some degree in virtually every end-use coatings segment, and represent the second most common type of resin system used in coatings formulations. Alkyds comprise roughly 20% of resin demand in the global coatings market (≤10% in the United States). Although alkyd resins have been steadily declining in use, particularly in North America and EU, as VOC limits continue to drop, and the market has been moving to other resin types for water-based and higher-solids formulations, newer water-based alkyd systems are being introduced into the market, at least in part due to the increasing interest in resins made with higher renewable resource content.

在全球范围内,几乎每个终端涂料市场都使用了醇酸树脂,它代表了涂料配方中第二种最常见的树脂体系。醇酸树脂约占全球涂料市场树脂需求的20%(美国≤10%)。尽管醇酸树脂的使用量一直在稳步下降,尤其是在北美和欧盟,但由于VOC限量不断下降,并且市场已经转向水性和高固含等其他树脂类型,之所以将新型的水性醇酸树脂系统引入市场,至少部分是由于人们对具有更高可再生资源价值的树脂越来越感兴趣。

Polyurethane coatings, either 1K, 2K (or occasionally 3K) are widely used in the automotive OEM, other transportation, automotive refinish, wood, industrial finishes, decorative coatings and even severe-service marine and high-performance industrial segments. Urethane resins currently comprise roughly 21% of the global demand for resins in coatings. Usage of polyurethane resins has been growing over the past several years due to their performance properties and their ability to be used in lower VOC formulations. An important, and growing, sub-segment of polyurethanes in the United States is 2K polyureas. To comply with increasingly stringent VOC requirements, polyurethane waterborne dispersions (PUDs) have been developed and used to formulate single-component coatings with improved abrasion resistance compared to waterborne acrylics. They can also be combined with other waterborne resins to meet cost targets and performance needs.

1K,2K(或有时3K)聚氨酯涂料广泛用于汽车OEM、其他交通运输、汽车修补漆、木家具、工业饰面、装饰涂料,甚至是要求苛刻的船舶和高性能工业领域。当前,聚氨酯树脂约占全球涂料树脂总量的21%。聚氨酯树脂在过去的几年中一直在增长,这是由于它们的性能和低VOC配方适用性。在美国,正在增长的一个重要聚氨酯细分市场是2K聚脲。为了满足日益严格的VOC要求,已开发了聚氨酯水性分散体(PUD),用于配制单组分涂料,与水性丙烯酸相比,其耐磨性得到改善。它们也可以与其他水性树脂结合使用,以满足成本和性能需求。

Approximately 16% of total demand for binders used in coatings is supplied by epoxy resins. Various resins in the epoxy family are widely used in electrodeposition (ED) coatings and in industrial coatings, particularly in the transportation, industrial maintenance and marine markets. Epoxy resins are also widely used in powder coatings. In recent years, high solids and ultra-high solids formulas using liquid epoxy resin dominate and continue to grow. Liquid epoxy resin is also used for 100% solids epoxy formulas applied as concrete surfacers, tank linings, and for other select applications, often augmented with phenoxy and novolac resins to enhance certain performance features. While the performance of waterborne epoxy resin technology has improved, even accounting for higher consumption due to its improved performance, it has only attained a small technology share, albeit with major usage in metal can coatings. These are, however, coming under increasingly close scrutiny in the United States, where BPA toxicity concerns continue.

约16%的涂料树脂原材料为环氧树脂。环氧族中的各种树脂广泛用于电沉积(ED)涂料和工业涂料中,特别是在交通运输、工业维护和海运市场中。环氧树脂也广泛用于粉末涂料中。近年来,使用液态环氧树脂的高固含量和超高固含量配方占主导地位,并继续增长。液态环氧树脂还用于100%固体含量的环氧配方,用作混凝土面漆、罐壁以及其他某些应用场合,通常会添加苯氧基和线型酚醛树脂,以增强某些性能。虽然水性环氧树脂性能在提高,其能耗也在提高,因此市场份额仍较小,主要用于金属罐涂料。然而,在美国,对BPA毒性的担忧仍在不断受到严格审查。

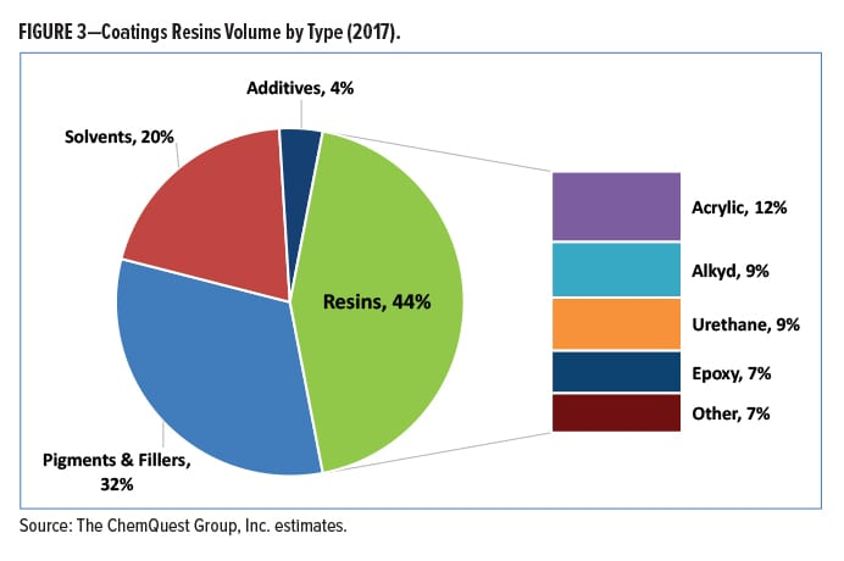

Additional binders that are used as coatings raw materials include amino, polyester (with low-bake versions as the growth area), cellulosic, silicone/polysiloxane, silicate and vinyl resins. Fluoropolymers are another interesting type, with waterborne versions now being offered for high-end architectural exteriors and other applications. Also included in this sub-segment are hydrocarbon resins and natural resins such as rosins and shellacs. While technically not resins, linseed oil, tung oil and similar products are also included since they act as film formers. This sub-segment comprises approximately 16% of total resin demand in the global coatings markets. Another small but growing resin chemistry is that of radiation cure, with the current greatest volume used in wood and plastic coatings—where sometimes even dual WB/UV cure technology is used. See Figure 3 for a breakdown of the major resin types.

其他涂料原料还包括氨基、聚酯(低烘烤型)、纤维素、有机硅/聚硅氧烷、硅酸盐和乙烯基树脂。含氟聚合物是另一种有趣的类型,水性体系已可用于高端建筑外墙和其他应用。该类别中还包括烃树脂和天然树脂,例如松香和虫胶。尽管从技术上讲不是树脂,但由于它们是成膜剂,此外还包括了亚麻子油、桐油和这类类似产品。这部分约占全球涂料市场树脂总需求的16%。另一个很小但正在发展的树脂体系是辐射固化,目前在木材和塑料涂料中的使用量最大,有时甚至使用双WB / UV固化技术。有关主要树脂类型的细分,请参见图3。

2. Pigments 颜料

The value and volume of pigments, both primary and secondary, for use in coatings formulations were estimated to be $16.5 billion on 11.0 million metric tons of product. On a volume basis, fillers and extenders are the largest sub-set of the pigments category and represent roughly 56% of all demand for pigments in the coatings market. Compounds that comprise this sub-segment include clay, calcium carbonate, talc, silica and other inorganic materials.

用于涂料配方的颜料的产值估计为165亿美元(基于1,100万吨产量)。以产量计,填充剂和增量剂是颜料类别中最大的细分产品,占涂料市场所有颜料需求量的56%。生成该细分产品的化合物包括粘土、碳酸钙、滑石、二氧化硅和其他无机材料。

The second largest sub-set of the pigments category is titanium dioxide (TiO2), which is the single highest-volume pigment used in coatings. Its largest use is in decorative coatings, but it is widely used in a variety of industrial OEM coatings and industrial maintenance/protective coatings, as well. Titanium dioxide represents approximately 31% of all pigments used as coatings raw materials, and this is likely to be somewhat problematic in 2018, with Q1 lead-times of 60–90 days, and scattered instances of allocation as well. The global economic climate currently favors all market segments that use TiO2, most notably the building and construction segment. This will, therefore, be a year of continued price increases, which could easily take TiO2 as high as $3100/mt, albeit still significantly short of its 2011–2012 historic high price of ~$4500/mt. Increases in Chinese chloride-process TiO2 production are essentially being offset by continued closure of sulfate-process plants, and Huntsman’s plant in Finland is not scheduled to be back to full production until the end of 2018. If the acquisition of Cristal by Tronox is finalized (the U.S. Government filed a complaint aimed at stopping the deal on December 5, 2017), it is unlikely to unleash any additional pigment into the market during 2018, although might be reasonably be expected to add an additional 100Kmt to global output in subsequent years.

颜料中的第二大细分是二氧化钛(TiO2),它是涂料中使用的最大量的单一颜料。它最大的用途是用于装饰涂料,但也广泛用于各种工业OEM涂料和工业维护/防护涂料。二氧化钛约占用作涂料原料的所有颜料的31%。这在2018年可能会有些变化。第一季度的交货期为60-90天,分配情况也很分散。当前,全球经济气候有利于所有使用TiO2的市场领域,尤其是建筑和建筑领域。因此,今年价格将持续上涨,尽管二氧化钛的价格仍远低于其2011-2012年的历史高价(4500美元/吨),但很容易将其价格推高至3100美元/吨。中国氯化物法生产的TiO2产量的增加基本上被硫酸盐法生产厂的继续关闭所抵消,芬兰的Huntsman工厂计划在2018年底之前恢复全部生产。如果Tronox对Cristal的收购最终敲定(美国政府于2017年12月5日提出了旨在停止该交易的投诉),尽管可以合理地预期在随后的几年中为全球产量增加100吨,但不太可能在2018年向市场释放任何其他颜料。

For certain end-use applications such as decorative, automotive OEM and automotive refinish, color is a primary driver of product selection. Hence, color pigments play a vitally important role in the coatings industry. Despite the importance of these materials, color pigments represent only a small component of pigment demand. Included in this segment are both inorganic and organic pigments. Inorganic color pigments such as iron oxide are the most frequently used and represent over 80% of the volume of color pigments. Organic color pigments are among the highest-priced raw materials and, thus, despite their relatively low volume, represent a significant portion of the market value. Organic color pigments are likely to increase 3–4% in 2018, as a result of competition for the basic chemicals from which they are built, and that largely come out of the AP region—production of which can be affected at almost any time as the Chinese government becomes increasingly proactive about shutting down chemical processes in an effort to improve air quality. Complex inorganic color pigments (often referred to as CICPs or ceramic pigments) are growing in importance because they meet the higher performance demands of chemical inertness and heat stability, along with lightfastness and excellent weathering properties. Moreover, with only a few exceptions (such as perylene black), CICPs comprise the majority of IR-reflective pigments that now enable formulation of various colors with energy efficiency properties. Color pigments represent >6% of the volume of all pigments used in coatings.

对于一些终端应用,例如装饰、汽车OEM和汽车修补漆,颜色是产品选择的主要驱动力。因此,彩色颜料在涂料行业中也起着至关重要的作用。尽管彩色颜料很重要,但彩色颜料仅占颜料需求的一小部分,该部分包括无机和有机颜料。无机彩色颜料(例如氧化铁)是最常用的颜料,占彩色颜料产量的80%以上。有机彩色颜料是价格最高的原料之一,因此,尽管它们的产量相对较低,但产值较大。有机颜料在2018年市场份额可能会增长3-4%,主要在AP区域,因为中国政府对关闭化学工厂越来越积极,生产随时受到政府的影响。复杂的无机彩色颜料(通常称为CICP或陶瓷颜料)正变得越来越重要,因为它们满足了化学稳定性、热稳定性、耐光性、耐候性等高性能要求。此外,除了少数例外(例如苯黑),CICP包含大多数红外反射颜料,这些颜料配方赋予节能属性。彩色颜料占涂料中所有颜料产量的6%以上。

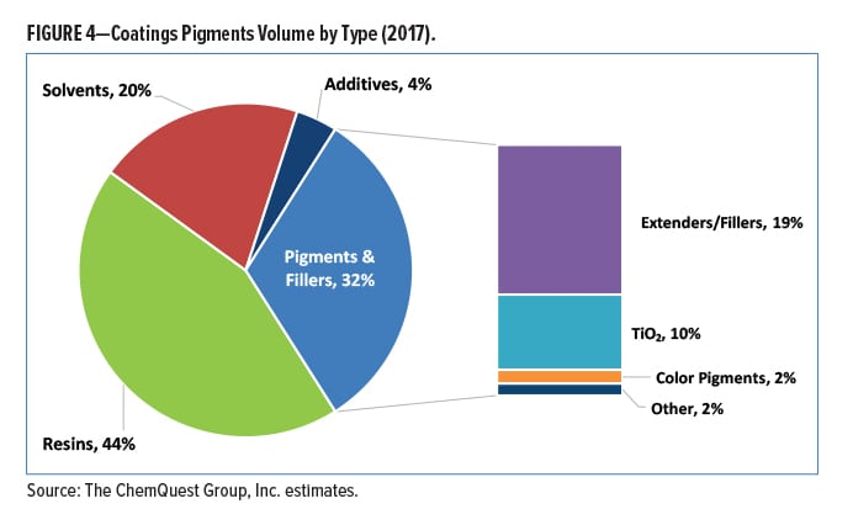

In addition to the pigments listed above, there is a wide array of other specialty pigments, such as anticorrosive pigments, metallic pigments, pearlescent pigments, carbon black and zinc oxide. While some of these pigments play an important role in coatings volume, none individually represents a significant volume. These other pigments represent roughly >6% of the total pigment demand. See Figure 4 for a breakdown of the major pigment groups.

除了上述颜料外,还有许多其他特种颜料,例如防腐颜料、金属颜料、珠光颜料、炭黑和氧化锌。尽管一些颜料在涂料中起着重要的作用,但没有一个颜料的产量具有代表性。这部分其他类颜料约占总颜料需求的6%以上。有关主要颜料的分类,请参见图4。

4. Solvents 溶剂

Solvents are the key contributors to the volatile organic content of paints and coatings emitted into the atmosphere and, as a result, are regulated by various local, regional, state and country regulatory agencies around the world.

溶剂是释放到大气中的涂料中挥发性有机物的主要起因,因此,它受到全球各地地方、地区、州和国家/地区监管机构的监管。

Global revenues for solvents used in coatings formulations in 2017 were approximately $8 billion on 6.5 million metric tons. Solvents account for 20% of total coating raw materials volume.

2017年涂料配方中使用的溶剂的全球收入约为650亿吨,约为80亿美元,溶剂占涂料原材料总量的20%。

Oxygenated solvents comprise over 60% of demand within coatings formulations, and include chemical components such as alcohols, ketones, esters, glycols and glycol ethers. Hydrocarbon solvents are either aliphatic or aromatic and comprise less than 40% of total usage within coatings formulations. As a result of the continuing shift in paint and coating formulations from solvent-based to water-based technologies, ultra-high solids and 100% solids, overall usage of solvents is declining as a percentage of the total coatings raw materials usage. While solvent usage as a percentage of total raw materials continues to decline, however, many end-use segments that use solvent-based coatings continue to grow. As a result, total solvent usage has been relatively flat over the past decade or so, and this trend is expected to extend into the foreseeable future. Similarly, within the solvents family, shifts are ongoing as formulators seek to find less toxic and more compliant, environmentally friendly solvents. Unfortunately, VOC regulations—and the concept of “what is exempt and what is not”—differ around the globe. For example, 2,2,4-trimethyl-1,3-pentanediol monoisobutyrate (“Texanol™”), historically the most effective coalescing agent for latex paints, is listed as non-exempt by the U.S. Environmental Protection Agency, but in the EU it is listed as exempt. This can make formulating “global coatings formulations” anywhere from tricky to impossible, depending upon the coating application, and performance requirements.

含氧溶剂占涂料配方的60%以上,其中包括化学成分例如醇、酮、酯、乙二醇和乙二醇醚。烃溶剂是脂族或芳族溶剂,占涂料配方总量的不到40%。由于涂料配方从溶剂型技术到水性、高固含和100%固含技术的持续转变,溶剂的使用总量在涂料原料中所占的百分比正在下降。尽管溶剂用量占原材料总量的百分比持续下降,但是,许多使用溶剂型涂料的终端市场仍在增长。结果,在过去的十年左右的时间内,溶剂的总用量一直相对平稳,这种趋势预计将延伸到可预见的未来。同样,随着配方技术人员的努力,溶剂体系也在向毒性更小、更合规、对环境友好的溶剂转变。不幸的是,VOC法规以及豁免的要求在全球范围内有所不同。例如,2,2,4-三甲基-1,3-戊二醇单异丁酸酯历来是乳胶漆最有效的聚结剂,但被美国环境保护署列为非豁免产品,但欧盟将其列为豁免产品。根据涂料应用和性能要求,这使任何地方想研发出“全球涂料配方”,从“棘手”变为“不可能”。

5. Additives 添加剂

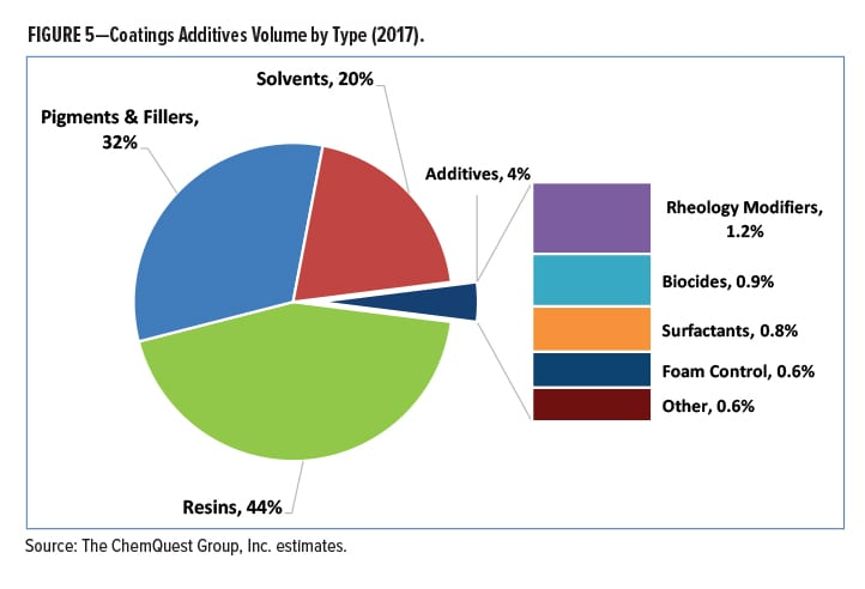

Additives comprise a broad category that covers a wide array of chemicals used as raw materials for coatings. Recent innovations include multi-functional additives to simplify the number of formula ingredients and also include those that help to achieve low- to zero-VOC formulations. Total revenue for additives used in coatings is estimated to be $8.4 billion on approximately 1.25 million metric tons.

添加剂涵盖了广泛的类别,涵盖了用作涂料原料的多种化学物质。最近的创新包括多功能添加剂用于简化配方成分的数量,或可助于实现低至零VOC配方。涂料添加剂的总产值估计为84亿美元(约125万吨)。

Rheology modifiers are the largest sub-segment, representing over 30% of demand, and are used to control viscosity and to affect flow and leveling. Plasticizers are incorporated into formulations to improve the flexibility of the film, and may also be used at times for their coalescent properties. Biocides are added to formulations to prevent the growth of bacteria and other microorganisms while the coating is being stored, and also as a dry film preservative. Biocides, including special chemical components that are used to minimize marine fouling, comprise approximately 22% of total additives used in coatings. Surfactants represent approximately 19% of additive demand on a volume basis, with foam control additives at 15%.

流变改性剂是最大的细分市场,占需求的30%以上,用于控制粘度并影响流动性和流平性。增塑剂,用以改善薄膜的柔韧性,并且由于其聚结性能,有时也可以使用。杀菌剂,可以防止涂层时细菌和其他微生物的生长,并作为干膜防腐剂。杀菌剂,包括用于最大程度减少海洋污染的特殊化学成分,约占涂料添加剂总量的22%。表面活性剂约占添加剂总量的19%,而泡沫控制剂占15%。

The list of other additives is quite long. While none represents a significant component of coatings raw materials individually, “Other Additives” collectively comprise a significant portion of all additives and include adhesion promoters, antifoaming agents, anti-skinning agents, corrosion inhibitors, driers, flatting aids, flood control agents, sag control agents, slip aids and UV absorbers, to name a few. See Figure 5 for a breakdown of the major functional classes of additives.

其他添加剂还有很多。尽管没有任何一种,可以单独代表涂料原料的重要组成部分,但“其他添加剂”也构成了所有添加剂的重要组成部分,包括增粘剂、消泡剂、防结皮剂、腐蚀抑制剂、干燥剂、平整助剂、防洪剂、流挂控制剂、助滑剂和紫外线吸收剂等。添加剂的主要类别细分,请参见图5。

6. Regional Distribution 地区分布

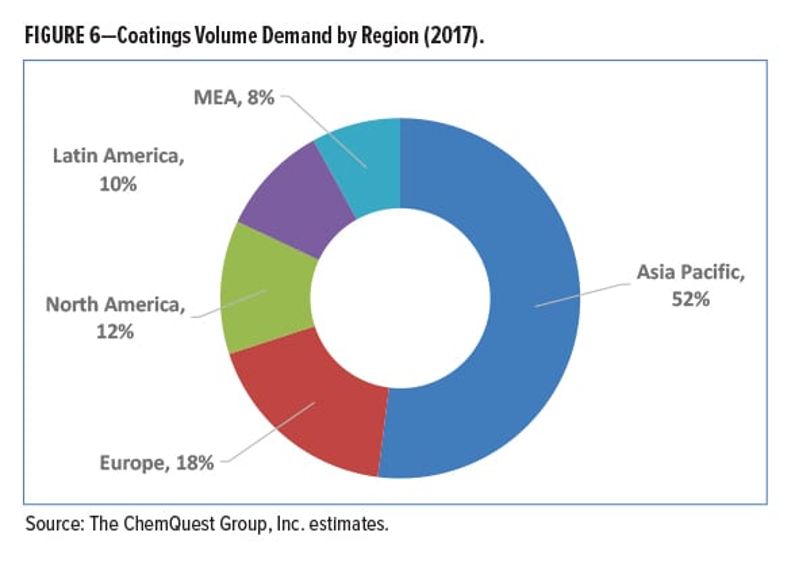

Globally, regional distribution of coatings raw materials generally follows overall production of coatings. Figure 6 depicts total global demand for coatings by region.

在全球范围内,涂料原材料的区域分布与涂料生产分布一致。图6描绘了按区域划分的全球涂料需求。

Competitive Landscape 竞争格局

The competitive landscape is quite complicated. In general, there are three types of competitors that operate in this market:

竞争格局十分复杂。通常,在此市场中运营的竞争对手共有三种:

The first type of competitor is large, multinational chemical companies serving many industries that compete across coatings raw material categories. Examples include:

第一类竞争对手是大型跨国化学公司,为许多行业提供服务,也在涂料原料类别之间竞争。例如包括:

o BASF

o Celanese

o Allnex

o DowDuPont

o Eastman Chemical

o Evonik

o Huntsman

o Lanxess

o Momentive

o W.R. Grace, et al.

Large, multinational chemical companies play a significant role in the coatings raw material market and command a considerable share of the raw material demand. The scale, degree of integration and broad product portfolios of these competitors are perceived as key advantages. Merger and acquisition activity among the large, multinational chemical companies has had a significant impact on the coatings raw materials market, and acquisitions are forecast to continue. Private equity firms continue to show an interest in acquiring raw materials suppliers.

大型跨国化工公司在涂料原料市场中发挥着重要作用,并在原料需求中占有相当大的份额。这些竞争对手的规模、整合程度和广泛的产品组合被视为关键优势。大型跨国化工公司之间的并购活动对涂料原料市场产生了重大影响,并且预计收购将继续。私募股权公司继续表现出对收购原材料供应商的兴趣。

The second type consists of multinational product specialists that focus on a limited product offering. These companies tend to specialize in a specific product or chemistry niche(s), and are frequently innovation drivers in the market. Competitors of this type vary widely in size, based upon geographic scope, product breadth and market focus. Examples include:

第二类由专注于有限产品供应的跨国产品专家组成。这些公司往往专注于特定产品或化学领域,并且经常是市场中的创新驱动力。根据地理范围、产品范围和市场重点,此类竞争对手的规模差异很大。例如包括:

o Cathay (pigments)

o Heubach (pigments)

o Nubiola (pigments)

o Alberdingk Boley (W/B resins)

o Reichhold (resins)

o Worlee-Chemie (resins)

o ALTANA (BYK—additives)

o Troy Corporation (additives)

o Michelman (additives)

As is the case with multinational chemical companies, mergers and acquisitions are anticipated to continue, impacting the specialist competitors as they are acquired by either larger chemical companies to complement their portfolio, or by other specialists to gain scope and share.

与跨国化工公司一样,并购预计也将继续,这将对专业竞争对手产生影响,因为大型化工公司通过收购它们来补充自己的产品组合,或者被其他专家收购以扩大范围和份额。

The final type of competitor is the local/regional suppliers. These generally focus on a limited product offering. Examples among the numerous local/regional suppliers:

最终一类是本地供应商。这些通常集中在有限的产品上。例如包括:

o Optimal Chemicals

o Organik Kimya

o Silberline Synthopol

o Specialty Resins

o OPC Polymers

o Orion Engineered Carbons

o Many, many others

While none of the local and regional suppliers have significant share on their own, collectively they are an important source of coatings raw materials. Competitors in this group offer an assortment of value propositions tailored to their customer mix. In some cases, due to lower overheads, local/regional suppliers are able to provide lower cost alternatives to the major suppliers. In other cases, they are able to provide unique products or services that allow them to effectively compete. Significant consolidation is anticipated among this group.

本地供应商所占市场份额都不大,但总体而言,它们也是涂料原料的重要来源。本地企业可为其客户量身定制产品。在某些情况下,由于较低的间接费用,本地供应商能够以更低成本代替国际供应商的产品。他们因独特产品或服务优势而有力竞争。预计本地供应商将进行重大合并。

7. Market Trends 市场趋势

Demand for coatings raw materials is directly linked to coatings demand. Over the coming five years, demand for coatings is anticipated to grow at a rate of 4–5% annually. This would result in a 2022 demand for raw materials of approximately 42 million metric tons. Asia Pacific is forecast to experience the greatest volume growth (5–6%) to 2022. Europe is likewise forecast to experience moderate growth of perhaps 3–4%. North America is forecast to post somewhat more robust growth of 4–5%, but the exact mix of raw materials consumed within each region will depend on specific end-use market growth.

涂料原料需求与涂料需求直接相关。在未来五年中,涂料需求预计将以每年4–5%的速度增长。到2022年,大约4200万吨的原材料需求。预计到2022年,亚太地区的销量将实现最大增长(5-6%)。欧洲也将有望实现3-4%的适度增长。预计北美地区会出现4-5%的强劲增长,但是每个地区的原材料需求将取决于该地区终端市场的增长。

Economic Influences 经济影响

Significant numbers of raw materials used in coatings formulations are either derived directly from oil for their chemical composition, or indirectly as a result of energy derived from oil for their mining and/or processing. The price of oil can be highly volatile and many factors can impact this forecast, driving the price/barrel either up or down. As a result, oil prices have a significant impact on the price of coatings raw materials. ChemQuest estimates that there is a “pass-through factor” of roughly 50%—i.e., if the price of oil doubles, raw material prices will increase by 50%. A realistic worst-case scenario might see prices of crude oil 50% higher than the forecast, which would increase raw materials for paints and coatings roughly 25%. Over the coming five years, the price of oil is forecast to remain relatively stable, within the range of $60–$70/barrel according to the U.S. Energy Information Administration (EIA). The implication for raw material suppliers and coatings formulators is that the price of the base materials that comprise coatings will likely rise at a rate similar to the rate of inflation to 2022.

涂料配方中使用的大量原材料要么是直接从石油中提取化学成分,要么是间接地从石油中提取能源用于开采和/或加工。石油价格波动频繁,受到许多因素影响而无法预测,每桶石油价格或上涨或下跌。因此,涂料原料的价格也受到重大影响。ChemQuest估计如果油价翻倍,原材料价格将上涨50%。现实中最坏的情况可能是原油价格比预期高出50%,这将使涂料的原材料价格增长约25%。根据美国能源情报署(EIA)的预测,在未来五年中,石油价格将保持相对稳定,在每桶60-70美元之间。对于原材料供应商和涂料配方设计师而言,这意味着涂料基础原料的价格可能会以类似于2022通货膨胀率的速度上涨。